Experts have forecasted the strongest growth for electric boats in Europe, ahead of North America, although there are large differences in supply, demand and interest across Europe. The latest market research(1) forecasts average annual growth of 12.7 per cent for electric boats until 2028 (CAGR).

For the study, boats.com analysed the data of 11 leading European online sales platforms for boats that have joined forces under the umbrella of Boats Group. In total, the analysis includes the search behaviour of 46 million potential buyers, particularly across the six main European marketplaces in UK, France, Italy, Spain, Netherlands and Germany of Boats Group. The data covers 2019 – 2023.

For the study, boats.com analysed the data of 11 leading European online sales platforms for boats that have joined forces under the umbrella of Boats Group. In total, the analysis includes the search behaviour of 46 million potential buyers, particularly across the six main European marketplaces in UK, France, Italy, Spain, Netherlands and Germany of Boats Group. The data covers 2019 – 2023.

Key Findings:

Since 2021, the range of electrically powered boats on the online sales exchanges has increased two-and-a-half times. Compared to 2019, the online exchanges recorded that the total electric boat listings on the platforms increased by 60 per cent in 2021, 160 per cent in 2022 and 190 percent in 2023.

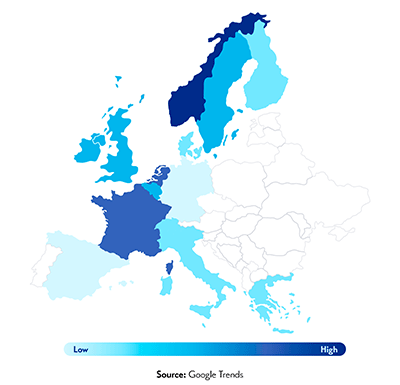

The Google Trend Analysis reveals that interest in electric boats is not equally strong in all countries across Europe. For example, the search engine recorded a particularly high number of searches for electric boats in Netherlands and France. In Belgium, Sweden, the UK and Ireland, there are also comparatively many searches for electric boats. Interest seems to be less pronounced among Spaniards and Germans at the moment.

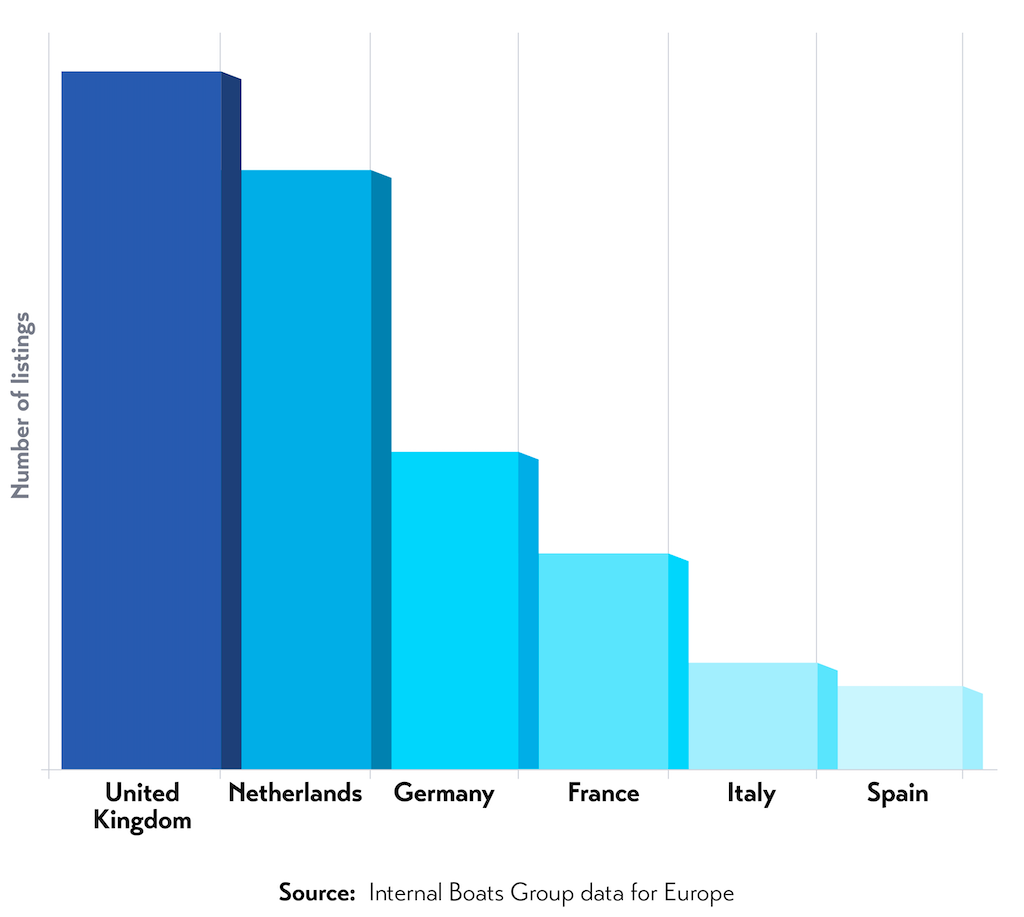

Most of the electric boats listed for sale on the online marketplaces have their moorings in the UK (1st), the Netherlands (2nd) and Germany (3rd). While interest is also high in the UK and the Netherlands according to Google Trend Analysis (above), a different picture emerges in Germany. There, the industry seems to be further along than the buyers. The southern European boating industry seems to be hesitant about electric boats. Compared to the rest of Europe, it is lagging behind in the electrification of its product range.

Electric boats are catching up, especially in the lower to high price segment. 38 per cent of the total electric boat supply on the online exchanges is in the entry-level and mid-price segment up to 50,000 €/GBP. So far, they are less common in the luxury segment, probably due to the overall increase in price sensitivity.

The supply of new electric boats on the European online exchanges is slightly larger (57 per cent) than the supply of used ones (43 per cent), but overall, it is balanced. It remains to be seen how the second-hand market for e-boats will develop. It is also interesting to note that electric boats sell 40 per cent faster than diesel boats on the platforms.

In conclusion the study reveals that the electric boat market is on the rise and shows no signs of slowing down. Now, northern European countries are at the forefront of this trend, with the largest supply and interest from buyers. In response to increased interest, electric boat brands are expanding their supply. As the world becomes more environmentally conscious and people are looking for more renewable and sustainable options in terms of transportation, the global electric boat market will take off and gain significant market share in the next five years.

- ELECTRIC BOAT AND SHIP MARKET SIZE & SHARE ANALYSIS – GROWTH TRENDS & FORECASTS (2023 – 2028), Mordor Intelligence